nj bait tax explained

5675 for distributive proceeds below 250000 652 for distributive proceeds between 250000 and 1000000 912 for distributive proceeds between 1000000 and 5000000 109 for distributive proceeds over 5000000. The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA.

The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT.

. The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1 2021. File Pay and Access Past Filings and Payments. 3246 into law referred to as the Pass-Through Business Alternative Income Tax Act or BAIT Act.

However as a New Jersey resident they will owe New Jersey income tax on their entire distributive share. Your PIN is printed on the Welcome Letter you received after registering your business. NJ BAIT is required to be calculated on every members share of distributive proceeds including exempt members.

On January 13 2020 the state enacted the Pass-Through Business Alternative Income Tax Act. Enter your taxpayer identification number and Personal Identification Number PIN. This results in a net tax due before credits for.

Come the New Jersey tax will be imposed at the full 9 New Jersey corporation level NJSA. New Jersey Pass-Through Business Alternative Income Tax NJ BAIT Act was passed in January 2020 and is effective for 2020. On January 13 2019 the New Jersey governor signed S.

The new law creates an election for pass-through entities PTEs to pay at the entity level and creates a corresponding tax credit for its members. Income between 0 and 30000 50 of the federal credit Income between 30000 and 60000 40 of the federal credit Income between 60000 and 90000 30 of the federal credit. 100000 5675 assuming their New Jersey tax rate mirrors the PTE rate 5675.

13 2020 New Jersey Gov. As you can see your New Jersey income is taxed at different rates within the given tax brackets. Income taxes domestic and foreign federal national state and local including franchise taxes based on income Taxable income the excess of taxable revenues over tax deductible expenses and exemptions for the year as defined by the.

The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT. An exempt member will have to claim a refund for its distributive share of the NJ BAIT paid by the PTE22 California. For income over 100000 you must use the New Jersey Tax Rate Schedule.

Log in below using the first prompt. What is New Jersey Business Alternative Income Tax - NJ BAIT Tax - Tax Tips With Ajay Kumar CPAITV Gold is the longest running South Asian TV station in the. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business. Tax is imposed on the sum of each members share of distributive proceeds which is 900000. 54A1-1 et seq in a taxable year.

The BAIT program is intended to give New Jersey individual income taxpayers a work-around of the 10000 annual limitation on the deductibility of state taxes imposed by the federal Tax Cuts and Jobs Act TCJA commonly referred to as the SALT deduction cap. Regardless of filing status the New Jersey credit percentages are. For purposes of the Federal 10-year firecognition periodfl for recognizing built-in gains the S corporation may recognize the Federal built-in.

Single member limited liability companies and sole proprietorships may not elect to pay the Pass-Through Business Alternative Income Tax. 5675 for distributive proceeds below 250000 652 for distributive proceeds between 250000 and 1000000 912 for distributive proceeds between 1000000 and 5000000 109 for distributive proceeds over 5000000. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business. 1418750 42380 900000-250000 650000 x 652 42380 5656750. The New Jersey pass-through entity tax took effect Jan.

Using the table above tax is calculated on the 900000 as follows. This act was designed to help business owners mitigate the negative impact of the federal state and local tax SALT deduction limitation of 10000 on individual tax returns. If an eligible partnership or eligible New York S corporation electing entity elects to pay the PTET its partners members or shareholders subject to tax under Article 22 personal income tax may be eligible.

New Jersey joined the SALT workaround bandwagon this year by establishing its Business Alternative Income Tax BAIT. The elective entity tax. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

Phil Murphy signed legislation creating the Business Alternative Income Tax BAIT an elective entity-level tax on pass-through businesses for tax years beginning on or after Jan. Bill S4065 increases the taxable income phase out threshold to 150000 of taxable income. In response to federal tax reform enacted in December 2017 New Jersey was.

A national trend ensuing the Tax Cuts and Jobs Act TCJA has been states attempts to circumvent the 10000 state and local tax SALT deduction. The New Jersey pass-through entity tax took effect Jan. For New Jersey income tax purposes income and losses of a pass-through entity are passed through to its members - and each member will then pay tax to New Jersey at the individual level based on the members share of the income and losses passed down.

New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub. Signed into law in January the BAIT is a new elective business tax regime in which New Jersey PTEs partnerships limited liability companies and S corporations can elect to pay an entity-level tax. If you use this option you can file and pay taxes and view information on past.

1 Effective immediately the legislation allows New Jersey pass-through entities PTEs to pay tax at the entity level and permits owners of. Any income less than 100000 taxpayers would use the New Jersey Tax Table or the New Jersey Tax Rate Schedule shown below. Trenton NJ 08695-0187 Corporation Business Tax Pass-Through Business Alternative Income Tax Only for tax-exempt corporate members other than IRC 501c3 entities and retire-ment plans of a pass-through entity that elected to pay the Pass-Through Business Al-ternative Income Tax and corporate pass-through entities that did not make an election but made a Pass.

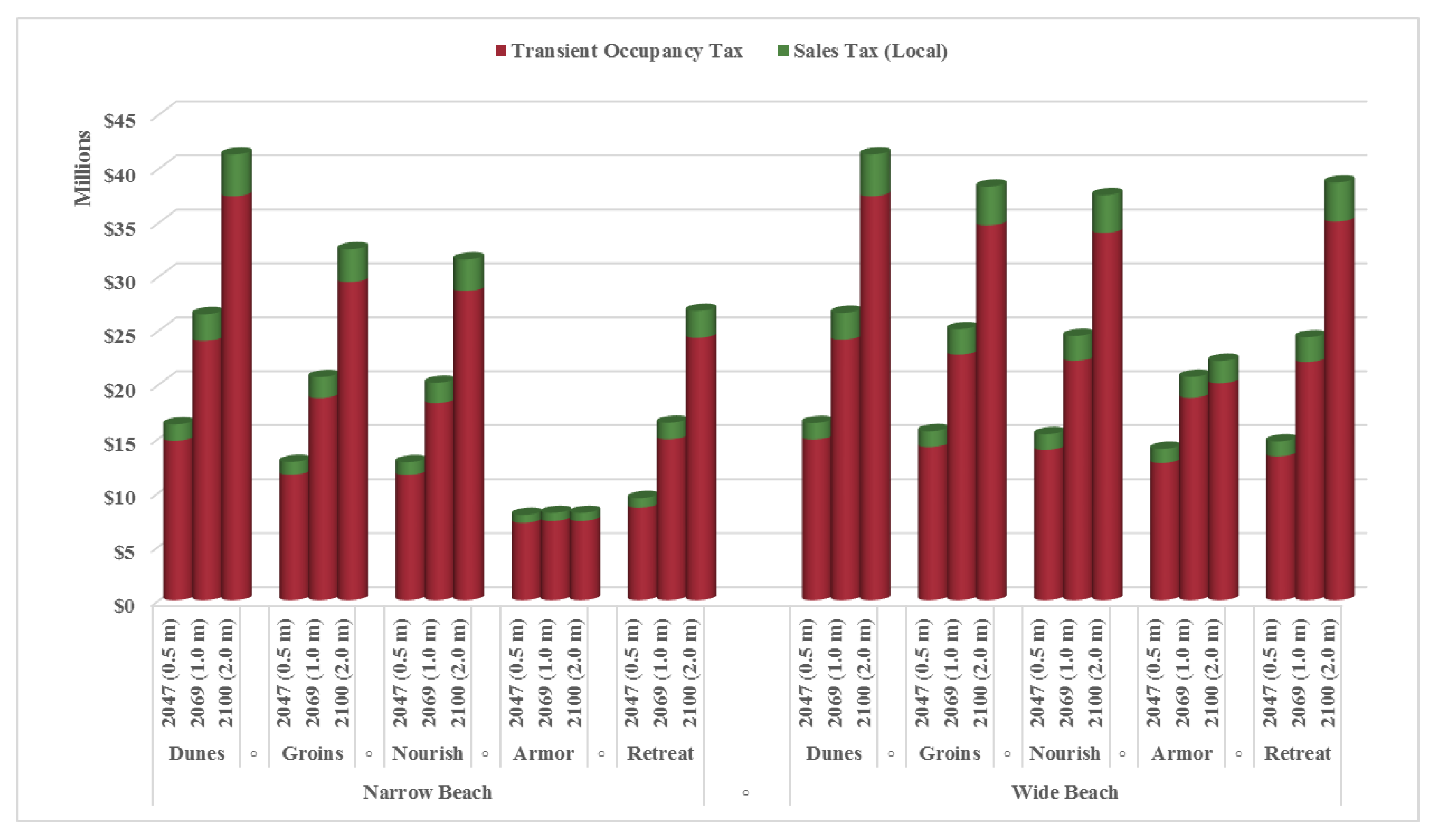

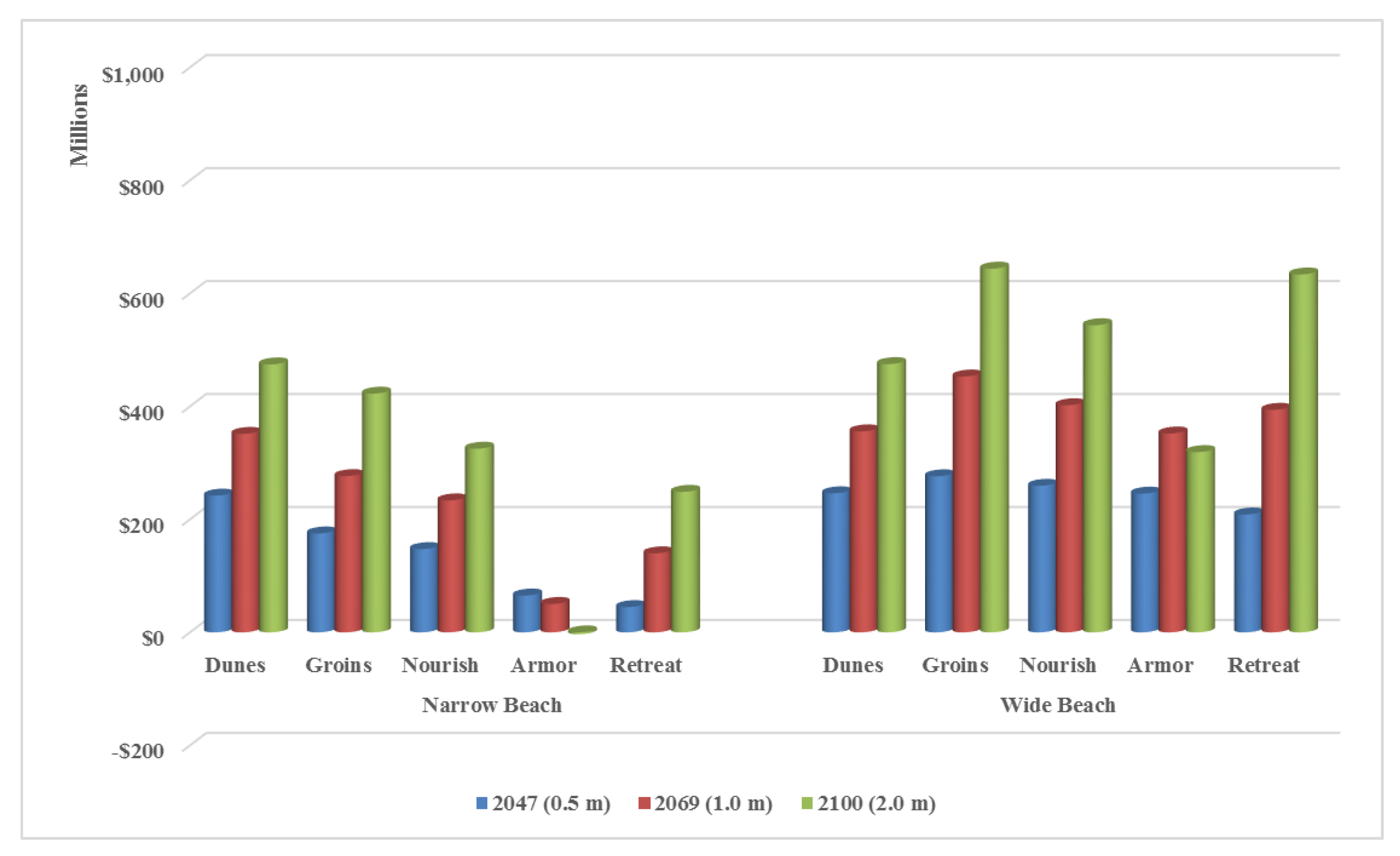

Water Free Full Text A Holistic Framework For Evaluating Adaptation Approaches To Coastal Hazards And Sea Level Rise A Case Study From Imperial Beach California Html

New Book Offers Advice For Starting And Advancing In Accounting

Water Free Full Text A Holistic Framework For Evaluating Adaptation Approaches To Coastal Hazards And Sea Level Rise A Case Study From Imperial Beach California Html

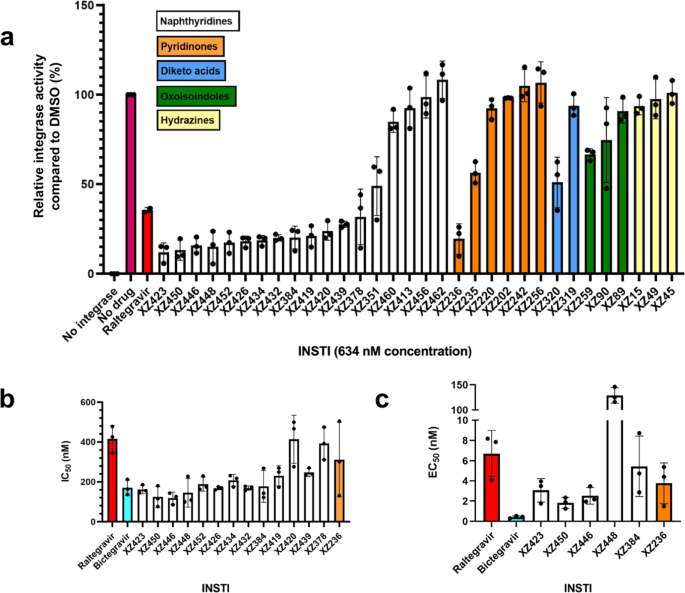

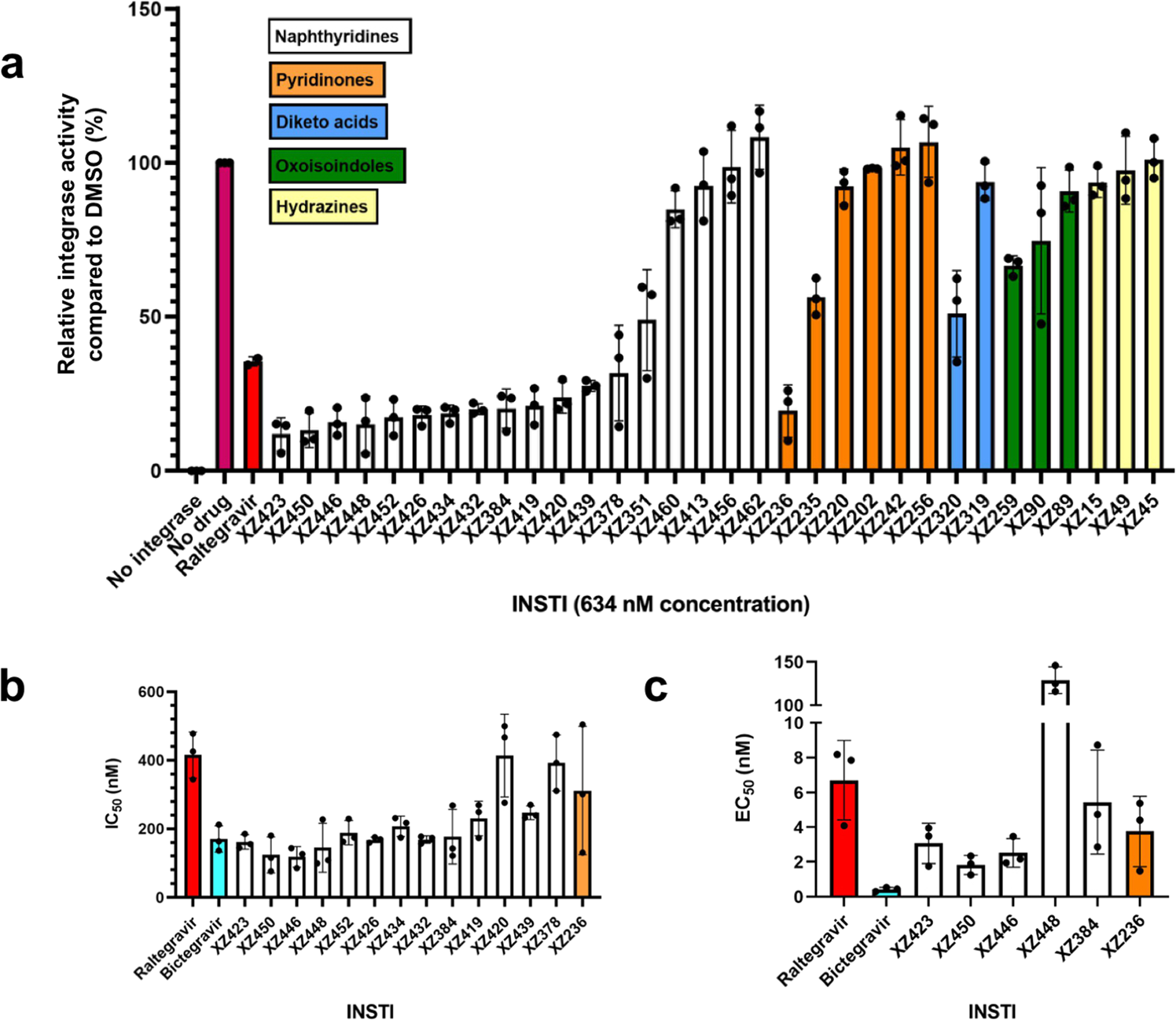

Structural Basis For The Inhibition Of Htlv 1 Integration Inferred From Cryo Em Deltaretroviral Intasome Structures Nature Communications

Issues In Institutional Design Part Iii Comparative Constitutional Design

New Jersey Enacts Salt Deduction Cap Workaround Grant Thornton

Philly S Soda Tax The Final Straw

Structural Basis For The Inhibition Of Htlv 1 Integration Inferred From Cryo Em Deltaretroviral Intasome Structures Nature Communications

New Jersey Cpa January February 2021 By New Jersey Society Of Cpas Issuu